There are ten Medicare Supplement (Medigap) plans that are designed to provide coverage for the out-of-pocket costs you may have while enrolled in Original Medicare (Part A and B). These ten plans are available in 47 states.

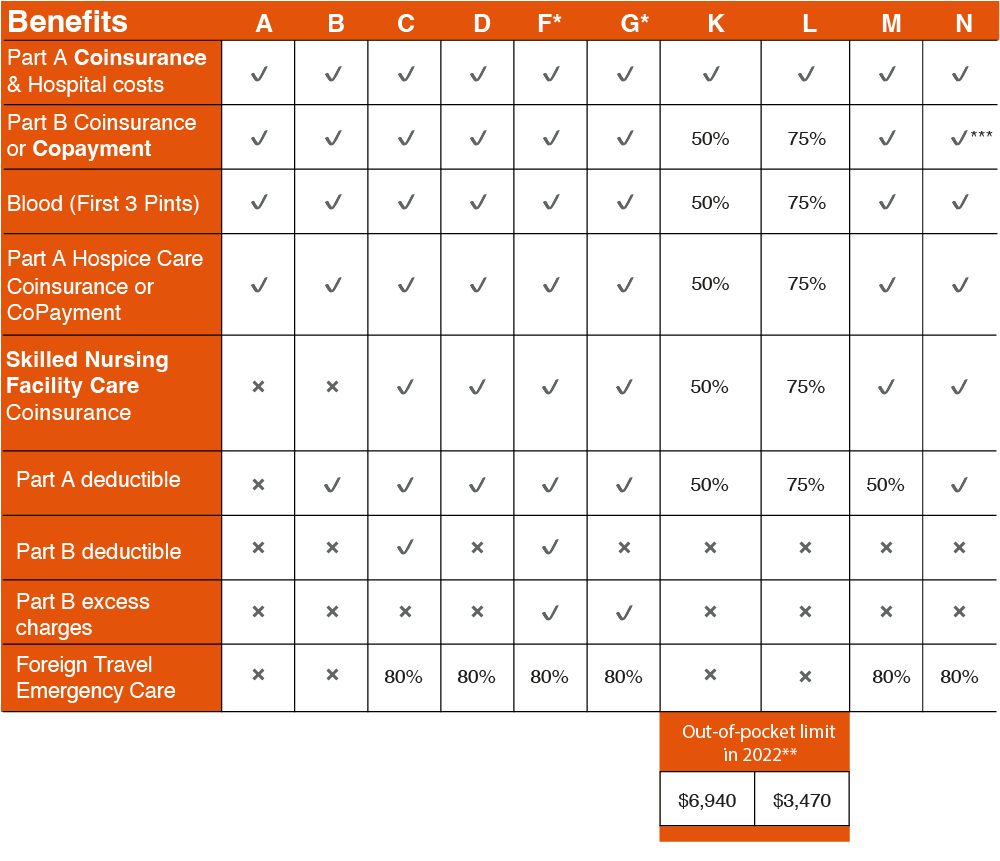

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,700 in 2023 before your policy pays anything. (You can’t buy Plans C and F if you were new to Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($226 in 2023), the Medigap plan pays 100% of covered services for the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance. You must pay a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Each plan will provide a certain amount of coverage for each of these services:

If you enroll in a Medigap plan, you need to ensure you have a prescription drug plan either through Medicare Part D or other coverage that’s considered to be creditable coverage.

Before you buy a Medigap plan, you must first be enrolled in Original Medicare. Once your Part B coverage is effective, you will have a six-month enrollment period to buy a Medigap plan without having to go through medical underwriting or being charged more in premiums because of your health.

Once you have your Medigap plan, here’s how its coverage will work: