Once you become eligible for Medicare, choosing your coverage may feel a bit overwhelming. There are several different components of Medicare that you must learn about before making a choice. In the following sections, we will compare your Medicare options.

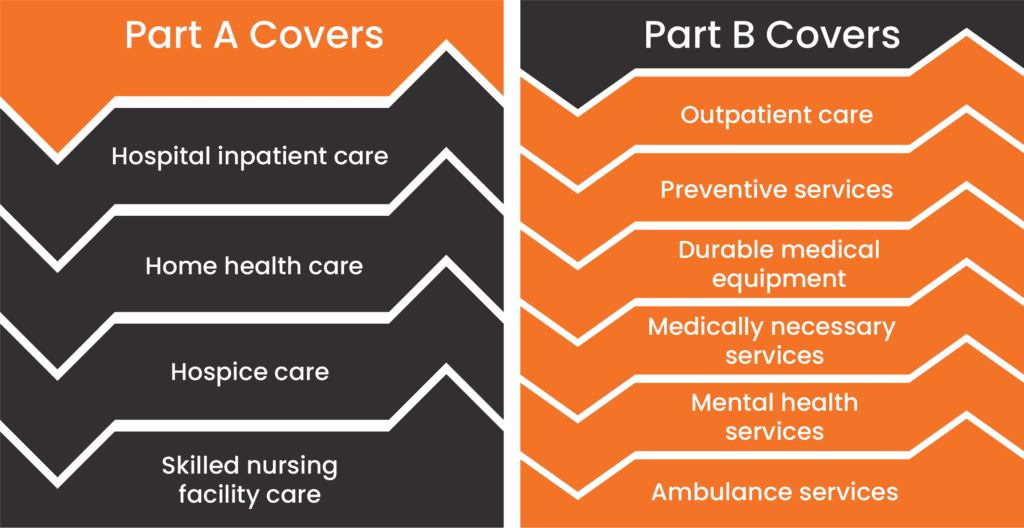

Original Medicare is the traditional Medicare plan. It consists of Part A hospital insurance and Part B medical insurance. Through these components, Medicare beneficiaries receive a majority of their health care coverage.

If you are interested in Original Medicare, this is what each Part of your benefits will offer:

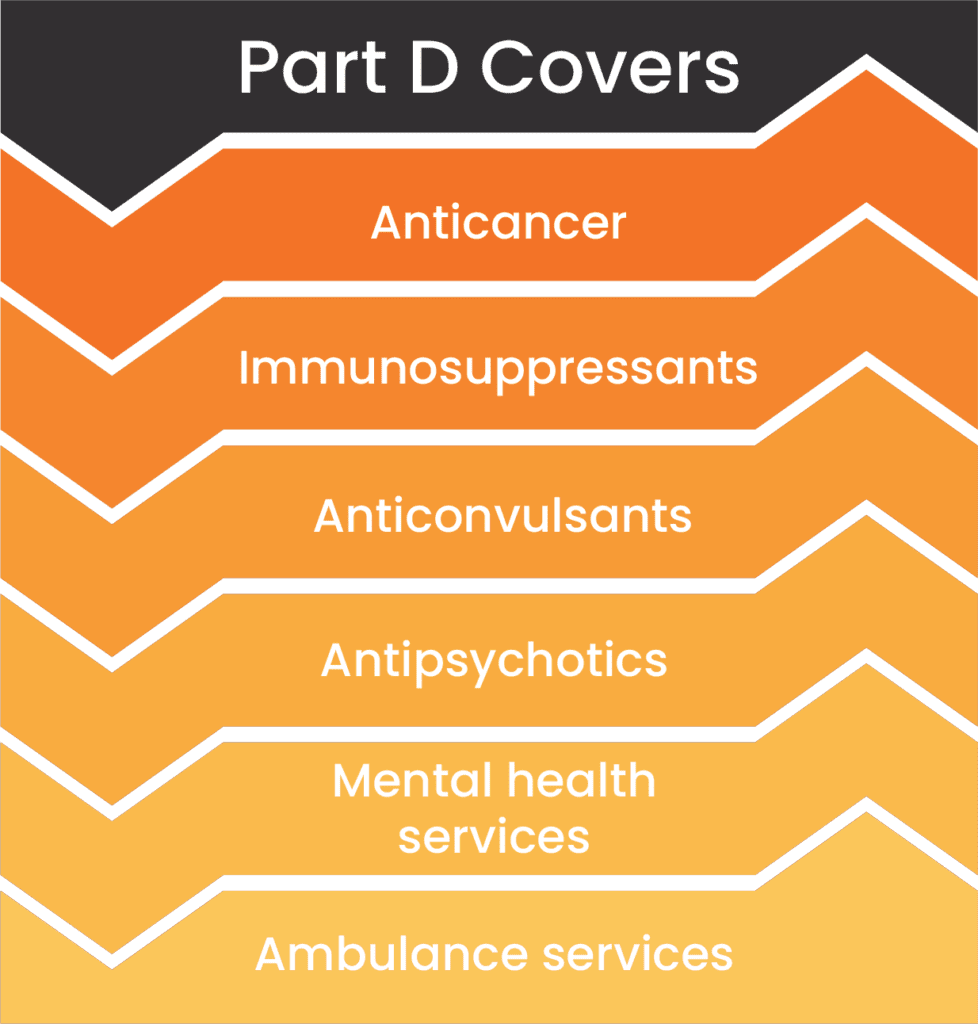

Part D of Medicare covers prescription drugs for Medicare beneficiaries. Medicare Part D is not a part of Original Medicare, but it is a supplemental coverage type that can normally only be accessed by Original Medicare members. Part D plans are sold by private insurance companies, unlike Part A and Part B benefits which are administered by the federal government.

If you don’t want Original Medicare, you do have an alternative option. Part C plans, or Medicare Advantage plans, are Medicare plans that are sold by private insurance companies. These companies contract with Medicare to provide Medicare beneficiaries with their Part A and Part B coverage.

Through a Medicare Advantage plan, you have more options for benefits and your benefits are also bundled into a single plan. The additional benefits you can get through Medicare Advantage include: